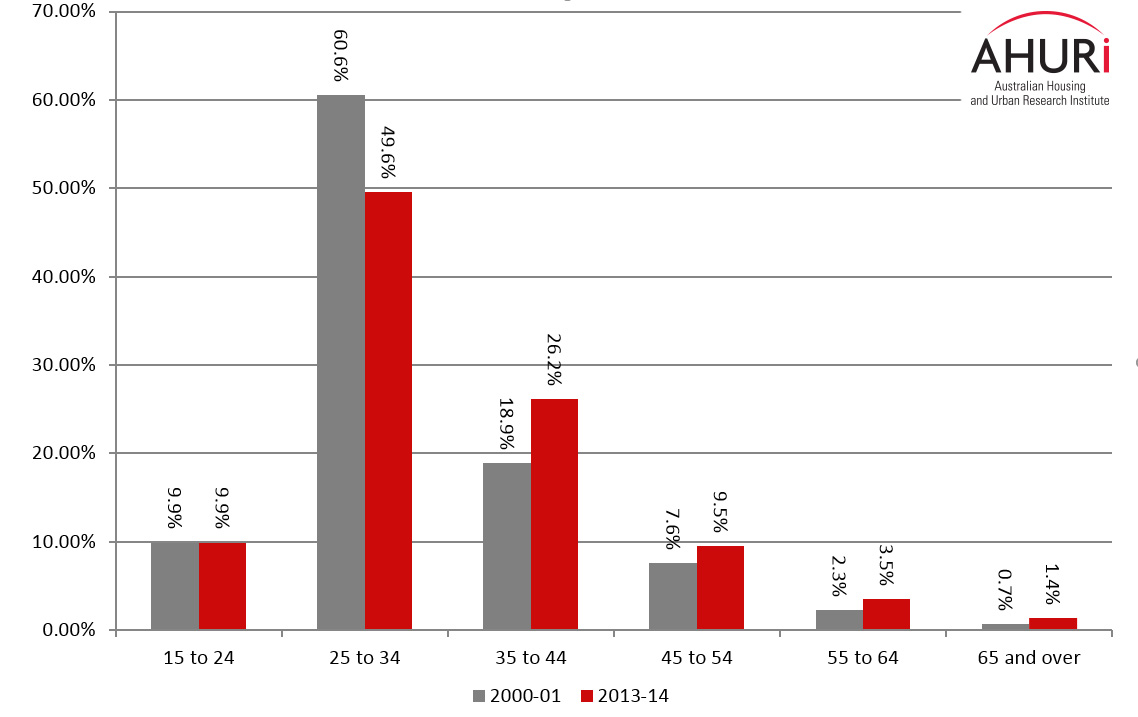

The most recent ABS Survey of Income and Housing 2013–14 reveals that households buying their first home are older than they were over a decade ago.

In 2000–01 over 60 per cent of first home buyers were aged between 25 and 34 years old, by 2013–14 that had dropped, with just under half (49.6%) of first home buyers being between 25 and 34 years old.

This indicates that households are delaying buying a home, which in turn could mean they are still paying off their home when they reach retirement age. Indeed, as other ABS Housing Occupancy and Costs data shows, the proportion of households aged 65 and over still paying off their mortgage has more than doubled, having risen from 3.6 per cent of all households aged 65 and over in 2000–01 to 8.2 per cent in 2013–14.

Figure 1: Age of first home buyers, 2000–01 and 2013–14

Source: ABS 4130 Housing Occupancy and Costs, 2000–01 and ABS 4130 Housing Occupancy and Costs, 2013–14.