High house prices (particularly in Sydney and Melbourne) have led to calls for the easing of supply-side restrictions such as opening up more land for development and speeding up the planning approval process. But will increasing the supply of new homes lead to more affordable housing for low-income households?

Does building more houses mean lower prices?

While increasing house supply is important (as it serves to stop house prices shooting up astronomically), it doesn’t cause house prices to drop to levels that are affordable to lower income households.

First, though we should be cautious in interpreting national level data, despite the number of homes being built exceeding Australia’s population increase, house prices have increased. Between September 2011 and March 2017 the number of residential properties in Australia rose by 9.5 per cent, outpacing Australia’s population increase of 8.2 per cent from 2011 to the end of 2016.

Despite dwelling supply increasing at a faster rate than the population, the mean value of residential properties rose by 36.5 per cent, from $490,800 in 2011 to $669,700 in March 2017.

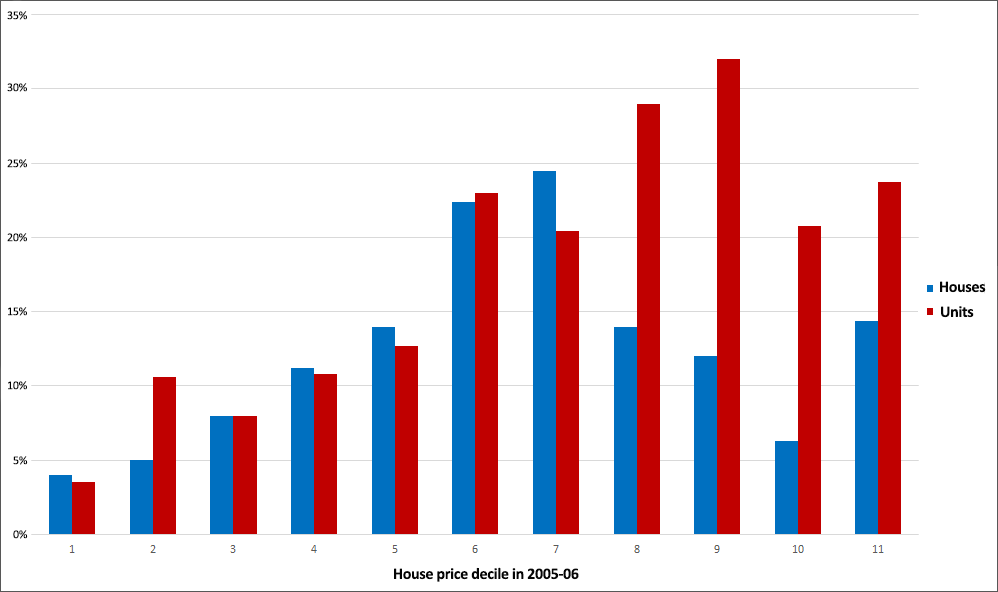

Second, the record numbers of dwellings that have been built over recent years have been overwhelmingly priced in the higher price deciles (i.e. where the value of new dwellings are ranked from lowest (1) to highest (10) prices). Research reveals that between 2005–06 and 2013–14 over 80 per cent of approvals for new houses were for properties in the more expensive 6 to 9th price deciles.

Figure 1. Growth in the stock of houses and units between 2005–06 and 2013–14, by real price decile, per cent

For units, 80 per cent of building approvals were in the 8th to the 10th price deciles.

Such numbers reinforce the Federal Treasurer’s statement in his speech to the ACOSS Post-Budget Breakfast, Sydney in May 2017, when he expressed ‘great disappointment … that there has been virtually no increase in affordable housing over the last decade in Australia’.

The numbers indicate that there is a supply side problem for low-income households in that the private housing market is simply unable to deliver housing that is affordable to those on lower (and, increasingly, moderate) incomes because there is a minimum cost of delivering housing that meets community standards. These costs are made up of the land price, taxes and other government charges, the physical construction costs of the dwelling and the profit required for taking on the development risk.

Increasing housing supply for low-income households

A very large number of dwellings (relative to the population) would have to be built to make a small reduction in house prices.

Research from the UK and USA shows that an extreme relaxation of planning controls (designed to increase rates of housing development) would be needed to noticeably impact on housing prices. Price modelling in England suggests that land supply would need to increase by more than four times to reduce housing prices by even a few percentage points. Other USA research modelling using metropolitan New York showed that to reduce land prices by half, 15 times more developable land would need to be supplied.

Treasurer Scott Morrison stated in his speech to ACOSS, that ‘Easing housing affordability should not just be our job, but a sound investment of corporate and private investors. We just need to ensure there are enough incentives and the return on investment for institutions to be encouraged to invest.’

Levels of general housing supply to match population growth are necessary but are not sufficient to address the supply of affordable housing for low-income households. In order to create housing that is affordable to low income households, an appropriate proportion of new housing supply has to be targeted at those income groups.

Treasurer Scott Morrison stated in his speech to ACOSS, that ‘Easing housing affordability should not just be our job, but a sound investment of corporate and private investors. We just need to ensure there are enough incentives and the return on investment for institutions to be encouraged to invest.’

A number of the 2017 Budget Measures are designed to increase affordable housing supply, including increasing the capital gains tax discount on affordable rental housing projects from 50 per cent to 60 per cent for investors; the National Housing and Homelessness Agreement (NHHA) to target jurisdiction-specific priorities including supply targets, planning and zoning reforms and renewal of public housing stock; and establishing the National Housing Finance and Investment Corporation (NHFIC) as an affordable housing bond aggregator to raise money at lower rates from the wholesale bond market for not-for-profit community housing providers.

Source:

Source: