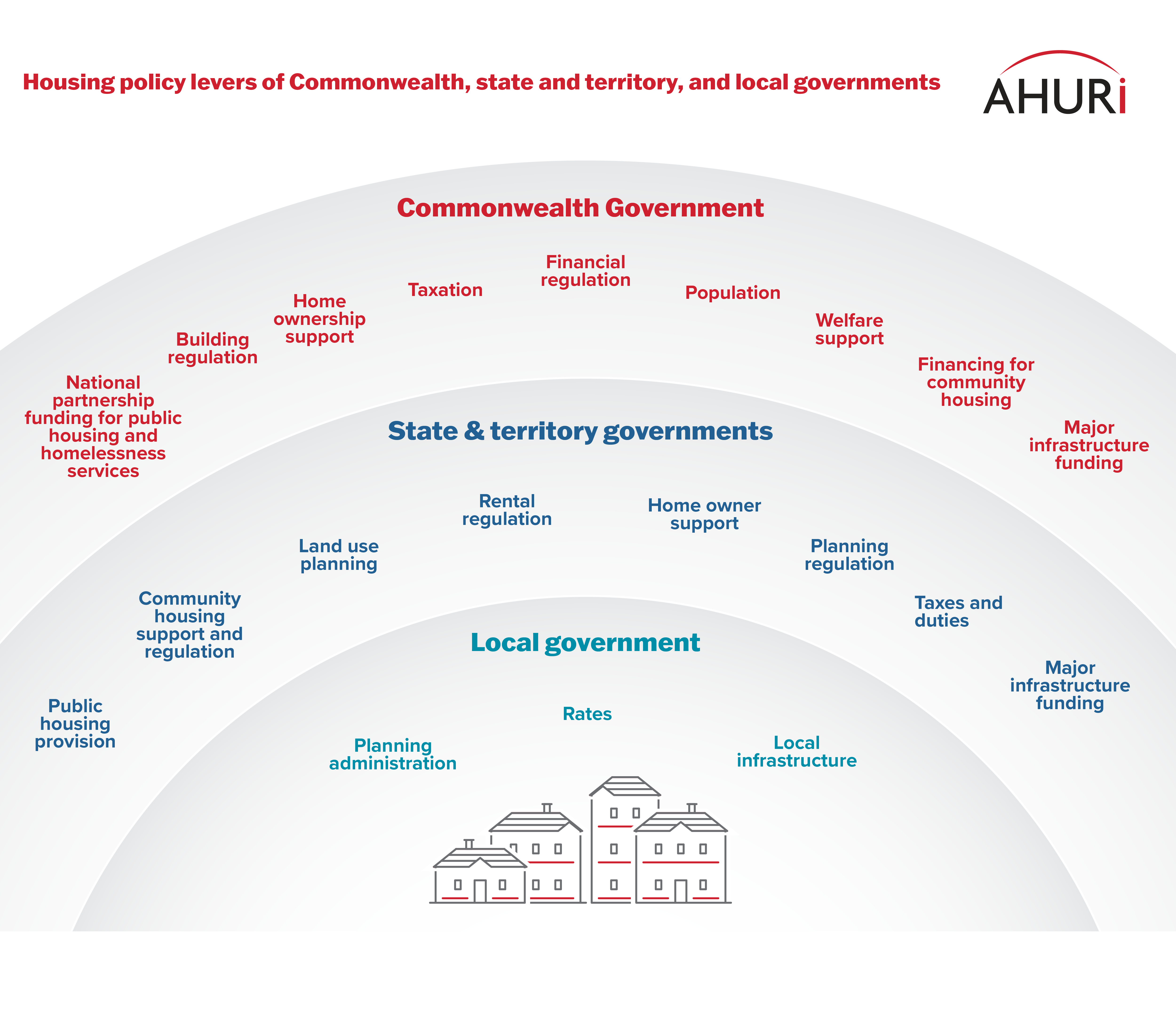

Understanding the housing policy levers of Commonwealth, state and territory, and local government

This AHURI Brief presents an overview of Commonwealth, state/territory and local government housing policy levers.

31 Jul 2023

Overview

The Commonwealth Government is leading development of a National Housing Accord that brings together all levels of government, investors and the residential development, building and construction sector to deliver quality, affordable housing supply over the medium term. The Commonwealth Government is also leading development of a National Housing and Homelessness Plan to help more Australians access safe and affordable housing. The Plan will be a 10-year strategy and will set out a shared vision to inform future housing and homelessness policy in Australia.

National Cabinet has sought two programs of work to be completed in coming months to address housing concerns: State and Territory Housing Ministers have been tasked with developing a National Cabinet proposal outlining reforms to strengthen renters’ rights across the country, while Planning Ministers, working with the Australian Local Government Association, have been tasked with developing a National Cabinet proposal on reforms to increase housing supply and affordability.

Each of these initiatives recognises the shared responsibilities for housing policy amongst the Commonwealth, state and territory, and local governments.

Just what are some of the major housing policy levers, controlled by Commonwealth, state and territory and local governments?

Commonwealth government

Population

A key Commonwealth Government impact on housing demand is through population change (increase or reduction) through migration policy. This includes policy settings to ease population pressures on Australia’s big capitals and supporting the growth of smaller cities and regions, and managing the rate of growth through the migration program.

Taxation

Another key Commonwealth Government mechanism that impacts on housing is the taxation benefits given to investors (i.e. negative gearing and capital gains tax reductions) and home owners (i.e. capital gains tax exemptions).

An emerging area of tax policy is the incentivisation of build-to-rent investment. The May 2023 budget reduced the withholding tax rate (from 30 per cent down to 15 per cent) for foreign investors using managed investment trusts to invest in BTR properties, as well as an increase in the tax depreciation rate for eligible new BTR projects from 2.5% to 4% per annum.

Financial regulation

Financial regulatory policies and controls have significant housing market impacts through their influence on the availability and cost of mortgage. The key institution with this responsibility is the Australian Prudential Regulation Authority (APRA). The Commonwealth Government has put implementation of monetary policy that underpins interest rates at a legal distance through the creation of the independent and autonomous Reserve Bank of Australia (RBA).

National Partnership funding for public housing and homelessness services

Through the National Housing and Homelessness Agreement (NHHA)—the most recent in a long series of Commonwealth-State housing agreements, the Commonwealth Government invests in states and territories to increase public housing and homelessness services.

Financing for Community Housing

The Commonwealth Government is also encouraging large scale investment by in social housing provided by community housing providers (CHPs) through an affordable housing bond aggregator and national housing infrastructure facility as part of the National Housing Finance and Investment Corporation (NHFIC) – to be renamed Housing Australia.

Welfare support

The Commonwealth Government provides Commonwealth Rent Assistance (CRA) to households renting in the private market that are receiving welfare benefits.

These payments can reduce housing affordability stress for eligible tenant households.

Other welfare benefits, such as Age pension, Disability support pension etc., support recipients with their housing and living costs. When such benefits are increased, as was the case during COVID pandemic, people’s ability to afford housing is improved.

Direct home ownership support

The Commonwealth Government provides support to eligible home buyers through the Home Guarantee Scheme administered by the National Housing Finance and Investment Corporation. NHFIC provides a Guarantee to a lender of up to 18% of the value of a home loan. This enables the home buyer to purchase without paying Lenders Mortgage Insurance.

Help to Buy is a new shared equity scheme allowing eligible home buyers to purchase a new or existing home with an equity contribution from the Commonwealth Government. The Commonwealth has committed to providing an equity contribution of up to 40 per cent of the purchase price of new homes and up to 30 per cent of the purchase price for existing homes.

Building regulation

The Commonwealth Government has oversight of building regulation nationally. The Australian Building Codes Board (ABCB) is a standards writing body responsible for the National Construction Code (NCC), which has the legal technical provisions for the construction and design of structures throughout Australia. The Nationwide House Energy Rating Scheme (NatHERS) provides energy ratings for new dwellings.

Major infrastructure funding

The Commonwealth Government invests in major infrastructure projects in partnership with the states and territories, as a part of their City Deals program. These investments, such as improving road and rail networks, may benefit tenant households by enhancing their access to regions with greater employment opportunities.

State/Territory Governments

Public housing provision

State and territory governments have an active role in funding and providing public housing in their jurisdictions to eligible householders.

Community housing support and regulation

To ensure that the community housing sector meets the housing needs of tenants and provides assurance for government and investors, state and territory governments regulate the sector through the National Regulatory System for Community Housing (NRSCH) and the Victorian Community Housing regulatory framework.

State and territory governments enable Community Housing Providers (CHPs) to manage and increase levels of social housing through transferring housing management (and sometimes ownership) to the CHPs.

Rental regulation

The private rental system is overseen by rental laws, known as the Residential Tenancies Regulations in each state and territory. Rental laws are different in each state and territory, though most include provisions regarding rights and responsibilities of renters (tenants) and rental providers (landlords), management of bond payments, and regulation around minimum standards.

Homeowner supports

There are a number of additional supports for home buyers at stage and territory government levels, including shared equity schemes such as the Victorian Homebuyer Fund, Keystart and Homeseeker.

Major infrastructure funding

As with the Commonwealth Government, state and territory governments invest in major infrastructure projects that can impact on housing supply and affordability.

State/territory governments are responsible for funding and providing infrastructure such as public transport, hospitals, roads and state primary and secondary schools that can affect housing outcomes in a particular area or region.

Land use planning

State and territory governments oversee the release into the market of non-residential land for development through land-use rezoning and development consent which can influence the type and location of new housing supply.

Planning regulation

The state and territory governments also oversees the environmental and other impacts of developments. They may also impose Inclusionary zoning rules which require developers to include affordable housing dwellings in their developments or to make payments so that affordable housing projects can be built elsewhere.

Stamp duty and Land Tax

State/territory governments set and collect stamp duties and land taxes that are applied to property sales and transfers.

Local Government

Planning administration

Local government is responsible for the administration of state/territory planning laws and, in some jurisdictions, can set additional requirements. These laws may determine building sizes, heights and qualities (including building materials). Planning overlays may also restrict what types and sizes of developments are possible in specified streetscapes and historical precincts.

Local government planning administration may also include Inclusionary Zoning rules that serve to increase affordable housing dwellings in the local government area.

Local infrastructure

Local government is responsible for local infrastructure projects such as libraries, tree planting, roads, drainage schemes and small bridges. Such projects may increase the desirability of living in a particular area, which in turn may impact affordability.

Rates

Local governments set and collect all council rates that are payable on residential properties.

This brief was first published 27 September 2018