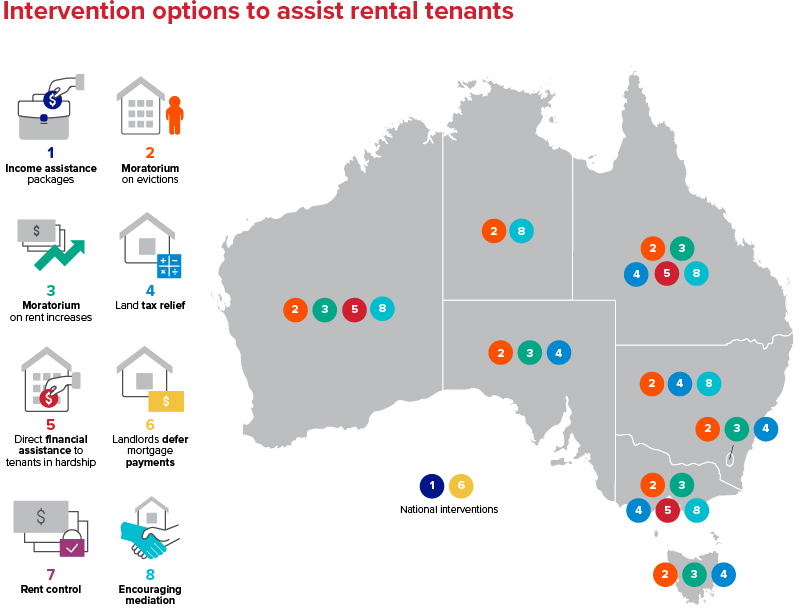

Although the Commonwealth Government, through the National Cabinet, has announced a moratorium on rental evictions due to the coronavirus for six months, residential tenancy laws are the responsibility of the states and territories, and as such vary across the country. Until a state or territory amends their residential tenancy laws, any changes decided by the National Cabinet are not legally binding on the residents of that state or territory.

The National Cabinet is made up of the Prime Minister and all state and territory Premiers and Chief Ministers, and has been established in order to make quick effective decisions in relation to the Covid-19 pandemic emergency.

Through the National Cabinet, the Commonwealth Government has facilitated a forum whereby the states and territories can discuss effective responses to the pandemic and learn from each other in real time. In principle this may lead to a more consistent national approach to both residential tenancy laws and how residential landlords and tenants are able to survive the economic consequences of the pandemic.