Public Private Partnerships to develop affordable housing

24 Nov 2022

Australia's affordable housing industry, where community housing providers (CHPs) supply affordable rental housing to households on low incomes, has, up to now, been modest and small scale. In order to expand so as to supply the large numbers of lower income households currently on waiting lists for public and community housing, the industry will need access to a large scale, dependable and sustainable source of finance that is available at an appropriate interest rate.

While Australian governments are unwilling to take on direct debt themselves to fund the affordable housing industry, there is interest in encouraging alternative sources of funding from the capital reserves held by large institutional investors such as Australian superannuation funds.

An AHURI investigative panel saw institutional investment as the most desirable source of finance to achieve long-term growth in supply of rental housing for a number of reasons.

- Demand is so large that no-one else (including government) has access to sufficient funds to provide the finance needed.

- Institutional investment offers efficiency gains from scale, and proportionally lower transaction costs for a small number of large investments rather than a large number of smaller contributions.

- Institutions are likely to view longer-term lettings more favourably and to provide a more stable and predictable source of funds than individual investors.

- Institutional investment will be needed if a new property asset class focused on income returns rather than speculative gains is to evolve.

Public Private Partnerships

In Public Private Partnerships (PPPs) governments contract providers to build and/or manage social housing infrastructure.

Typically, initial funds for capital investment are raised by a private partner rather than the government. This investment is repaid over the concession period specified in the contract, through ongoing payments by the government as well as revenue from user fees. This is an advantage for the government in that such a funding model does not necessarily count in its financial books as a debt and can enable governments to initiate development of new projects without a substantial negative effect on its credit records.

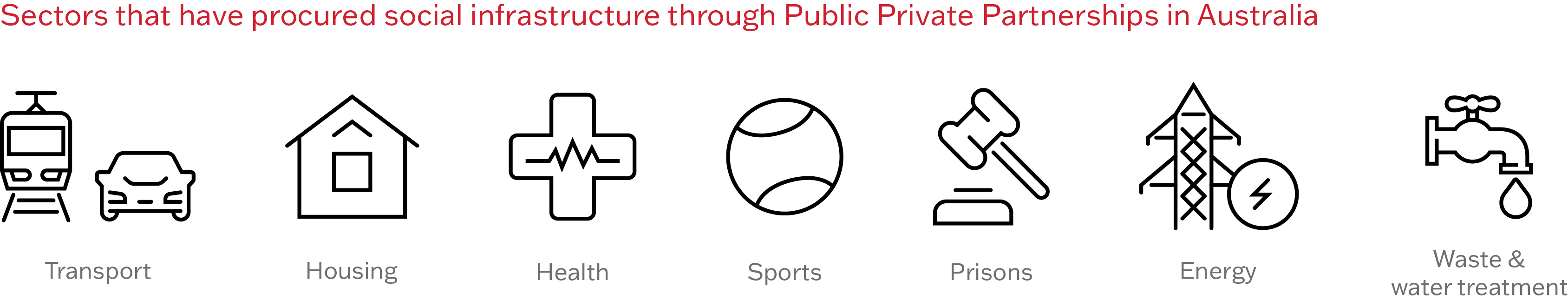

By the mid-2000s, an estimated 10–15 per cent of all Australian infrastructure investment came through PPPs, with 29 social infrastructure and transport projects contracted from 2005 to September 2009, the majority of these in NSW (10) and Victoria (9). In NSW, PPPs have procured social infrastructure and non-core services in a wide range of sectors, including transport (motorways, rail), housing, health, sports (Sydney Olympic Park) and other public services such as prisons, energy, waste and water treatment.

In Australia, the first social housing PPP redevelopment was to have occurred in the south-west Sydney suburb of Bonnyrigg. At the time of the signing of the initial contracts, the NSW government estimated the costs of facilities and services would be 6.3 per cent lower than if redevelopment was undertaken by government itself. However the Bonnyrigg PPP ran into trouble, with the developer Becton going into receivership in 2013, which meant the NSW Government has stepped in to complete the development.

Are PPPs beneficial?

Funding developments through PPPs often involves an added degree of complexity as potential cost efficiencies may be balanced by high initial transaction costs given the investment required in the tendering process, the length of time it typically takes before contracts are finalised, and the legal and administrative fees along the way.

Research estimated that bidding costs for projects with a capital value up to $250 million are typically around $2.5 million, rising to up to $6 million for a $1 billion project. Significant start-up costs are also involved in putting together teams with necessary skill sets. The typical time for a contract to be signed for projects in Australia is 17 months.

Internationally PPPs have been more common for social good enterprises. In the US, the most significant use of PPPs for social housing has been through HOPE VI. The program has invested US$5.5 billion to renovate 224 public housing estates, resulting in some 150 000 public housing units being demolished to make way for reconstruction. The financial aims typically involve mixing private debt or equity with public subsidy, and using income from sales of private dwellings to offset the capital costs of rebuilding.