Research looking at the decade 2001 to 2010 found there were three groups of home owners: ongoing owners who are able to buy and keep their home either as outright owners or buyers; leavers, who sold their dwelling and didn't buy another; and churners, who sold their dwelling and then after a period of renting bought another dwelling to live in. One in five Australian home owners and buyers show instability in their housing tenure—moving from owning to renting and, some, back again.

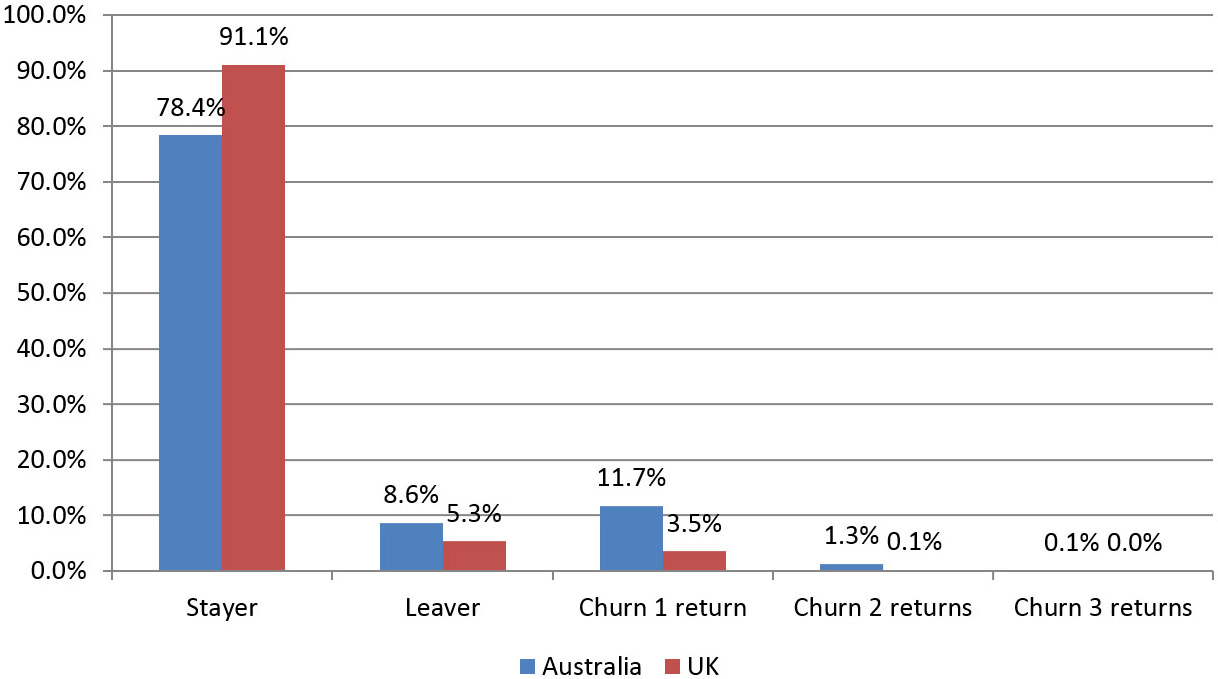

Figure 1. Ongoing home owners, leavers and churners, Australia and UK, 2001–2010

Source: Wood, G., Smith, S., Ong, R. and Cigdem, M. (2013) The edges of home ownership, AHURI Final Report No. 216.

When compared to the UK, Australia had higher proportions of households who were leavers (8.6% of households) or churners (13.1% of households in the above graph). These high rates of exit from home ownership and increasing indebtedness across the life course challenge Australia's age pension retirement policy, which is based on householders having low housing costs in old age.

One potential reason for the lower rates of UK households selling their home is that home buyers may be eligible for government assistance through 'support for mortgage interest'. There is no such program for mortgagors in Australia.