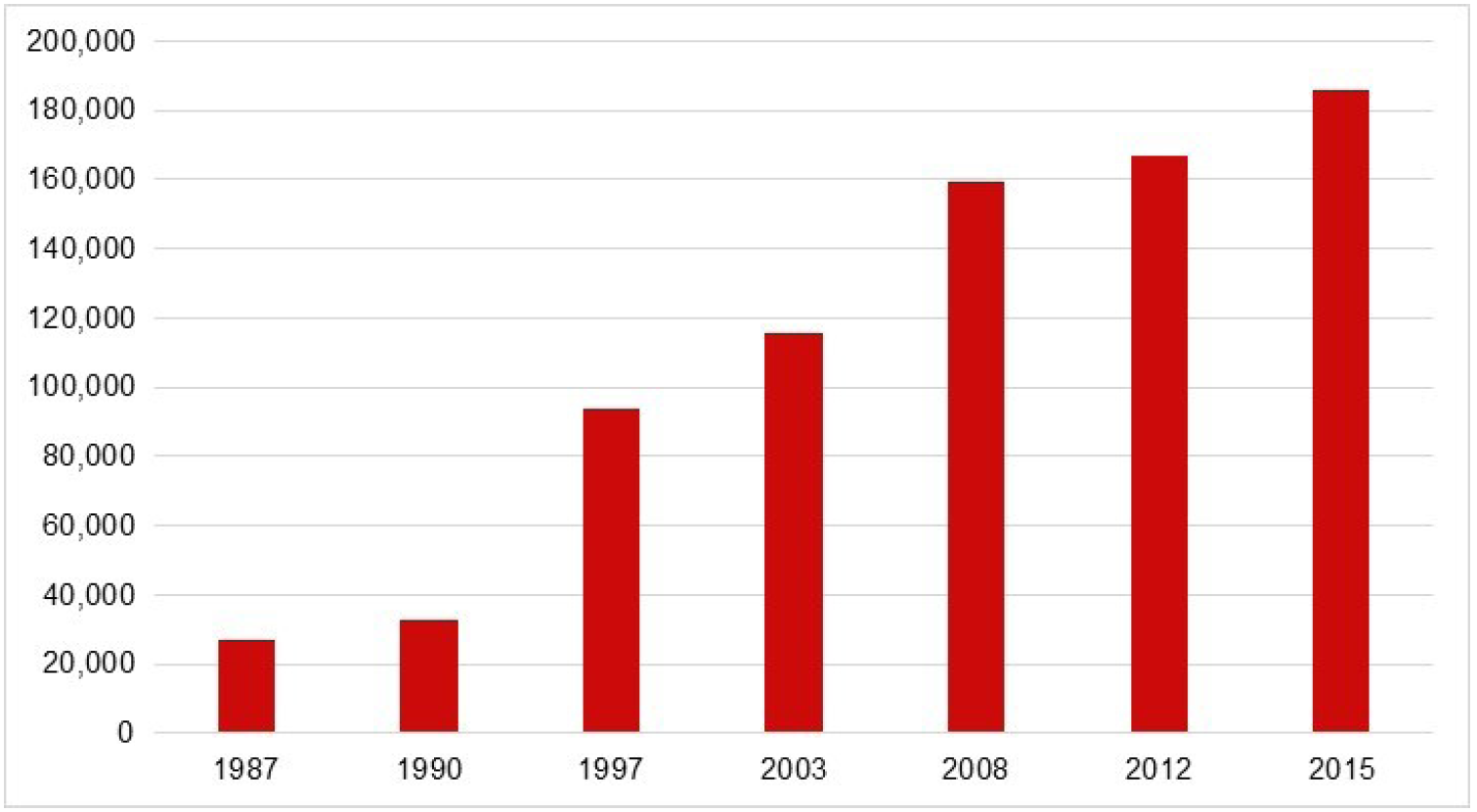

The rise in home ownership in Australia since the second world war has led to more retirees owning their home outright by the time they finish their work lives, meaning they can live on a lower age pension (traditionally dubbed the fourth pillar of the retirement incomes policy). However the number still paying off their home after they retire has risen, from 14 per cent of older mortgagees (aged 55+) in 1987 to nearly 27.5 per cent in 2015. In addition, the average mortgage debt owed on their property has risen from $27,206 to $185,757 (a 582% increase) while disposable incomes only rose by 129 per cent (from $38,346 to $87,908 in $2015).

Figure 1: Mean trend in mortgage debt for mortgagors aged 55+, 1987–2015 (real $ in 2015 values).

Notes: Estimates are weighted using cross-sectional population weights provided in the SIH dataset. Source: Survey of Income and Housing (SIH).

According to recent AHURI research, having a mortgage once a person retires does carry risks of decreased mental health, as recorded by the SF-36 Survey, and higher levels of psychological distress, as recorded by the Kessler K10 Psychological Distress Scale.

| SF-36 Survey | Kessler Psychological Distress Scale (K10 Scale) |

|---|---|

| The SF-36 Survey provides a measure of mental health derived from a short-form survey on health and wellbeing, with the higher the score, the better the mental health. | The K10 Scale is a score of non-specific psychological distress based on a questionnaire about negative emotional states, including tiredness, nervousness, restlessness and depression, with the higher the score, the worse the mental health. |

Compared to older outright owners, in 2015 older mortgagors reported a lower SF-36 mental health score of 75.7 (compared with 77.6 for outright owners) and higher psychological distress scores of 15.2 (compared with 14.3 for outright owners). Those older mortgagees paying a smaller proportion of their income in mortgage costs had better mental health than those mortgagees who paid a larger proportion of their income in mortgage costs.

If older mortgagees are late or miss their house repayments, their mental health levels decrease significantly: the SF-36 scores of men drop by 2 points and those of women drop by 3.7 points. Late mortgage payments also raise males’ K10 psychological distress scores by nearly 2 points. These effects are comparable to those resulting from long-term health conditions.

To enhance the quality of life and mental health for older Australians it is important that mortgage indebtedness and mortgage repayment stress be minimalised.