Forty per cent of renters can’t afford essentials as a result of COVID-19: report

A new report surveyed and analysed the circumstances of Australian renters during the initial phase of the COVID-19 lockdowns

16 Oct 2020

Almost 40% of Australian tenant households can’t afford essentials such as bills, clothing, transport and food, after paying rent, because their incomes have reduced significantly during the COVID-19 pandemic, new research from the Australian Housing and Urban Research Institute has found.

The research, ‘Renting in the time of COVID-19: understanding the impacts’, led by the University of Adelaide surveyed 15,000 public and private renting households across all Australian states and territories during July and August 2020.

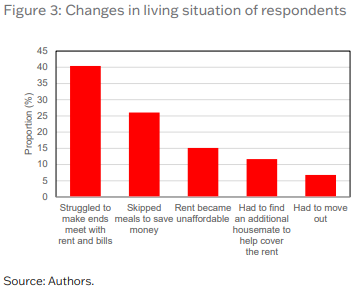

Among those affected, one in four reported that they struggled to make ends meet with rent and bills, a quarter had skipped meals, and around 12 per cent sought an additional housemate to help pay their rent. One in six respondents reported that their rent had become unaffordable. Of particular concern, there was a clear gradient of effect, with lower income households more likely to report more negative effects on their living situation

The research identified challenges for the rental sector and brings insights into how the rental market is performing, the uptake of existing support measures and the demand for future assistance.

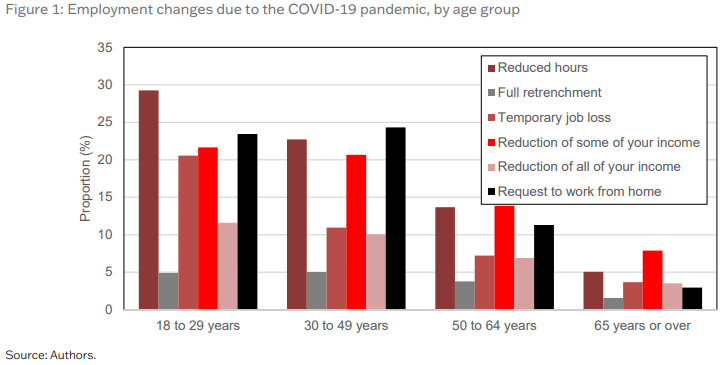

According to the research, as a result of the COVID-19 lockdowns, Australian tenant households earning less than $90,000 per year had higher rates of reduced working hours (up to 26% of households), temporary job loss (up to 16%) or reduction to overall income (up to 11%) when compared to higher income households.

One in six respondents reported that they had accessed government income assistance, such as JobKeeper or JobSeeker, for the first time, with low-to-moderate income households having a higher need for assistance.

‘COVID-19 has been devastating for many Australians but those in the rental sector have been particularly impacted,’ says project leader Professor Emma Baker, University of Adelaide Professor of Housing Research. ‘...The pandemic has placed many people in the rental market at risk; they face uncertainty, tenure insecurity, financial hardship and significant mental health effects.’

Around half of survey respondents indicated that their mental health had been negatively affected by COVID-19 lockdowns and just over 10% reported that this had been significant. Victorian respondents, who have experienced the longest period of lockdown nationally, were 1.5 times more likely than respondents in other places to report negative effects on their mental health. Of interest, the odds of people reporting decreased mental health was around 30 per cent higher if they were required to work from home during the pandemic.

‘COVID-19 has been devastating for many Australians but those in the rental sector have been particularly impacted,’ says project leader Professor Emma Baker, University of Adelaide Professor of Housing Research. ‘The pandemic, and the subsequent economic and social lockdown, has rapidly changed our housing system: the way we use our homes, our ability to afford them, and the role of government safety nets. The pandemic has placed many people in the rental market at risk; they face uncertainty, tenure insecurity, financial hardship and significant mental health effects.’

In examining the stability of tenancies during the pandemic, researchers found that just over 5% of respondents had been issued with an eviction notice during the pandemic. Even though some of those tenants benefitted from state and territory eviction protections, just over half of households issued with eviction notices went on to be evicted.

‘With the on-going health and economic effects of the COVID-19 pandemic still evolving, if these savings and superannuation buffers eventually run out, renters will be entirely dependent on packages of government support.

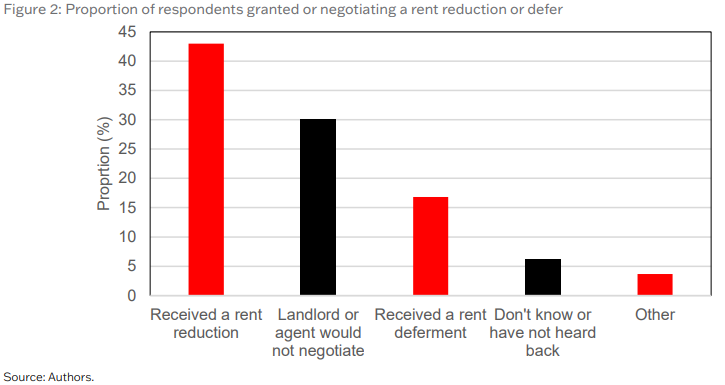

In addition, 16% of tenant households surveyed had requested a rent alteration (either a deferral or reduction) as a result of COVID-19-related hardship, and of those households, 30% said that the landlord would not negotiate or did not respond to their request.

The report also found there is considerable uncertainty about the need for government income support into the future. When households were asked if they think they will need financial assistance in the coming 12 months, 28% responded that they would, 31% said they did not know and 40% said that they would not.

‘Many renters are currently buffered from the full economic effects of the pandemic by their savings, their superannuation and rent deferment, as well as a temporary government supports in the form of eviction moratoriums, JobKeeper and JobSeeker,’ says Professor Baker.

‘With the on-going health and economic effects of the COVID-19 pandemic still evolving, if these savings and superannuation buffers eventually run out, renters will be entirely dependent on packages of government support. In the absence of an effective and accessible vaccine, it is likely that the situation for renters captured in this mid-2020 snapshot will be different—and almost certainly worse—by mid-2021.’

This reports, as well as our many related news items and briefs, is available on our updated COVID-19 Research Hub where content is organised by 9 key research themes identified as part of the development of our COVID-19 research agenda.

The report can be downloaded at http://www.ahuri.edu.au/research/final-reports/340