Inheriting housing wealth shapes education and work careers

New AHURI report finds adult children who inherit housing wealth get ahead in education and business start-ups

07 Mar 2017

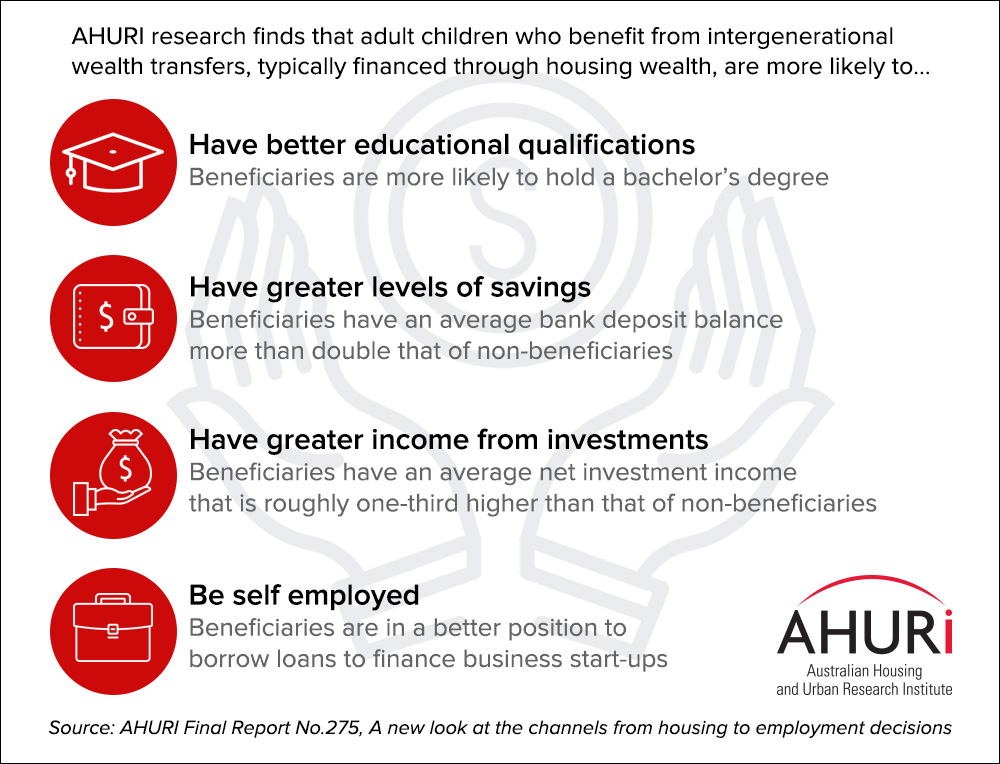

A new AHURI report, ‘A new look at the channels from housing to employment decisions’, undertaken by researchers from RMIT University and Curtin University, explores if intergenerational wealth transfers (as bequests or parental cash transfers), which are typically financed through housing wealth, shape the education and work careers of those who receive the benefit.

The report’s findings show that people who received cash transfers or bequests from their parents have better educational qualifications than people who haven’t received such a benefit, and in particular are more likely to hold a bachelor’s degree. They also have greater levels of savings—with average bank deposit account balances more than double and average net investment income that is roughly one-third higher than those of non-beneficiaries. In addition, a significantly higher proportion of beneficiaries are self-employed when compared with non-beneficiaries.

In the decade 2002 to 2012, approximately 1.8 million Australians inherited money at least once, and the average amount of each inheritance was $79 000, although the median inheritance was much lower at $25 000. Over the same time-period, 5.8 million Australians received one or more cash transfers. The average amount of any one cash transfer ($4600) was much smaller than the typical size of inheritances, and the median was $1000.

...as intergenerational transfers become more important, they could become an increasingly significant cause of inequality of opportunity, and so this growing wealth divide will warrant attention from policy makers.

The report articulates that ‘as intergenerational transfers become more important, they could become an increasingly significant cause of inequality of opportunity, and so this growing wealth divide will warrant attention from policy makers.’

Professor Gavin Wood, one of the report’s authors from RMIT University, says ‘Our report confirms that intergenerational transfers help beneficiaries to ‘get ahead’, by being better able to complete a university education, while also more prepared to use their housing wealth to start business and self-employment ventures. Governments might wish to encourage this use of housing wealth by alerting homeowners to the tax advantages of using their homes to launch business start-ups.’

The research report is available to download from the AHURI website at http://www.ahuri.edu.au/research/final-reports/275