Young households struggle to buy a home, with first homebuyer rates lagging previous generations

20 Jul 2023

The home ownership rate of first home buyers born in the late 1980s is significantly less than was the case for first homebuyers born in previous decades, and even after 20 years, the rate of ownership is still only 75 per cent of the rate earlier decades, new AHURI research has revealed. The research, ‘Transitions into home ownership: a quantitative assessment’, undertaken for AHURI by researchers from University of Sydney and RMIT University analyses the economic constraints over the last four decades on people’s ability to buy a home.

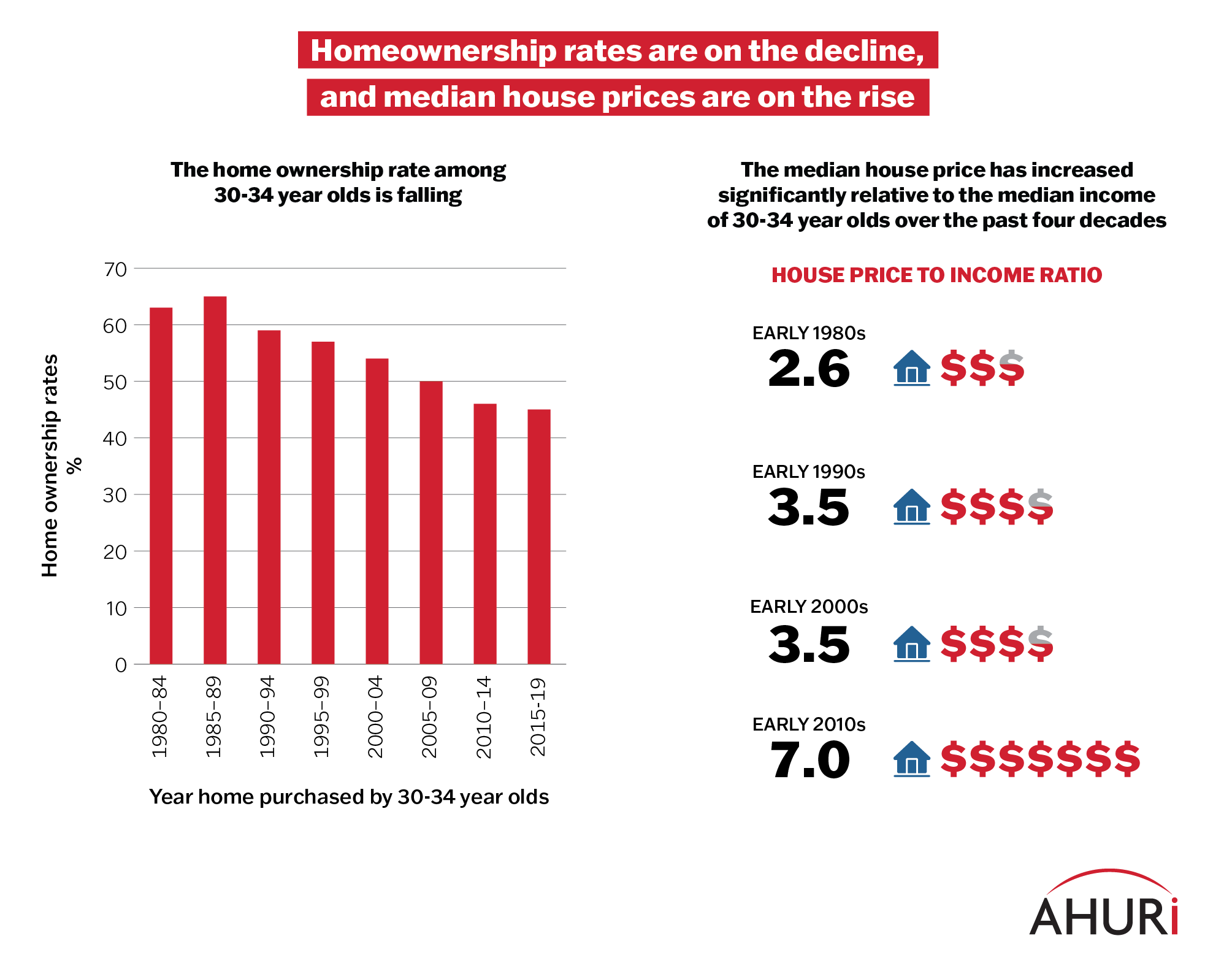

‘Our research certainly shows that over the last 30 years, ownership rates for households at age 30 to 34 have declined substantially; from 65 per cent of people born in the mid to late 1950s being home owners by age 30¬ to 34, to only 45 per cent of people born in the mid to late 1980s’, says Professor Stephen Whelan of the, School of Economics University of Sydney, one of the authors of the research. ‘This fall in ownership rate has happened as house prices have nearly tripled, indicating that increasing house prices and falling affordability are associated with a delay in housing market entry for Australian households.’

‘But more importantly, while this may represent in part simply a delay in younger Australians buying a home, our research shows that as these younger groups of people grow older they are less likely to ‘catch up’ and buy a home. After 10 years the ownership rate ‘gap’ when comparing the 1950s cohort to the 1980s cohort (at age 40 to 44) has closed by less than half, and after 20 years (at age 50 to 54), the ownership rate is only around 75 per cent of the 1950s group.’

If these younger age groups aren’t able to catch up about buying a home there are fears among policy makers that Australia may see large falls in living standards and increases in poverty among people who have retired but are still renting.

‘One of the key constraints younger people are facing in wanting to buy a home today is the need to save enough to be able to pay a deposit or downpayment’, says Professor Whelan. ‘If we measure housing affordability by the time required to save for a deposit for a ‘typical’ dwelling for an ‘average’ household, we see that in markets such as Sydney and Melbourne it now takes over six years.’

To get over the ‘insufficient deposit’ problem, both in Australia and internationally, parents now represent an important source of finance for younger households either through cash transfer, by being able to save money while still living at home or by parents acting as a loan guarantor. Indeed, the ‘Bank of Mum and Dad’ is estimated to be among the top ten mortgage providers in Australia. Research analysis shows that a transfer of $10,000 is associated with nearly double the probability of a younger household buying their first home.

‘While transfers of cash from parents to children is part of that family support there is also an increasing tendency for younger Australians to reside in their parents’ home. This allows younger Australians to accumulate savings in the order of $300–$400 per week that can be used to buy a home,’ says Professor Whelan. ‘Every additional year that a young person lives at home, as opposed to renting elsewhere, leads to an increase in the odds of transitioning into first-time home ownership of approximately 30 to 40 per cent. Similar to direct money transfers, this in-kind assistance provides an important, albeit informal, way into home ownership.’

One consequence of intergenerational transfers from parents to children is the increase in the level of inequality in the society. In Australia, wealth is clearly associated with housing tenure; over the period 2002–2018 the largest growth in wealth was observed among (often older) outright-home owners while renters, the least wealthy group, experienced very limited increases in wealth.

Critically, familial support is unlikely to be available to all individuals. This highlights the need for well targeted government policies directed at potential first home buyers who might otherwise never be able to buy.