The recent speech by the Treasurer Scott Morrison to the Urban Development Institute of Australia (UDIA) outlined the challenges face by home owners and would-be homeowners, and highlighted a number of findings from AHURI research.

In particular, the Treasurer pointed out that the proportion of single income households buying a home has fallen since 1981, information drawn from the AHURI Final Report, ‘Generational change in home purchase opportunity in Australia.’

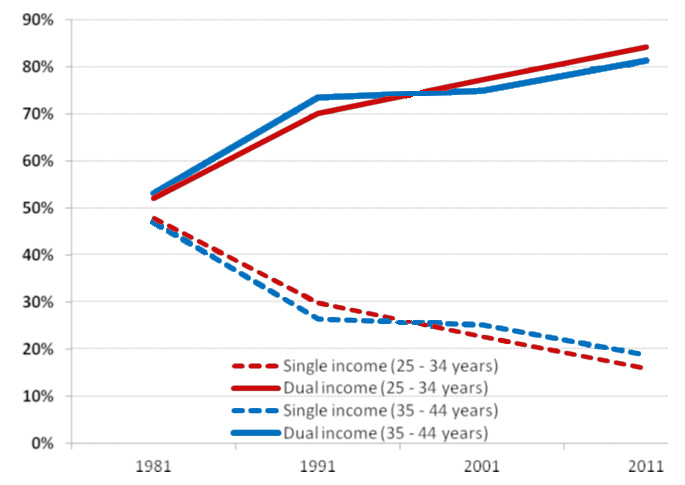

The research shows the proportion of home buyers aged 25–34 who are single income households has fallen from 47.9 per cent in 1981 to 15.8 per cent in 2011, while the proportion of 35–44 single income home buyers has fallen from just under 50 per cent in 1981 to around 19 per cent in 2011. The data shows that, increasingly, a younger household has to have two incomes to buy a house.

Source: AHURI Final Report 232 (2014) ‘Generational change in home purchase opportunity in Australia.’

The research also shows that the overall proportion of 25–34 homeowners (i.e. outright owners and buyers) has fallen from 61.3 per cent in 1981 to 51.3 per cent in 2011. In addition, the proportion of households aged 55–64 who are still buying their home has risen from 24.3 per cent in 1981 to 32.2 per cent in 2011. This has implications for housing affordability if householders retire while they still are paying off a mortgage.