Media reports suggest that, due to the impact of the coronavirus and economic downturn, more than 1.4 million Australian households are now in mortgage stress and almost 100,000 could default on their home loans as a result.

In mid-June (19 June 2020) the Australian Banking Association reported that 485,063 home loan mortgages had been deferred at a total value of $175.5 billion. It is anticipated that when Government welfare supports such as JobSeeker and JobKeeper wind back in September 2020 the economic situation for many households will deteriorate even further.

For lower income homebuyers (i.e. earning in the bottom 40% of Australia’s income distribution) levels of mortgage stress were already high before the coronavirus pandemic. Previous AHURI research into mortgage stress revealed that in 2007–08 (during the GFC) 60.7 per cent of in lower income homebuyers who had bought in the previous three years had mortgage payments of 30 per cent or greater of household income—equating to 147,100 households (up from 38.5% in 1981–82).

Coronavirus recession leaves Australians in mortgage stress

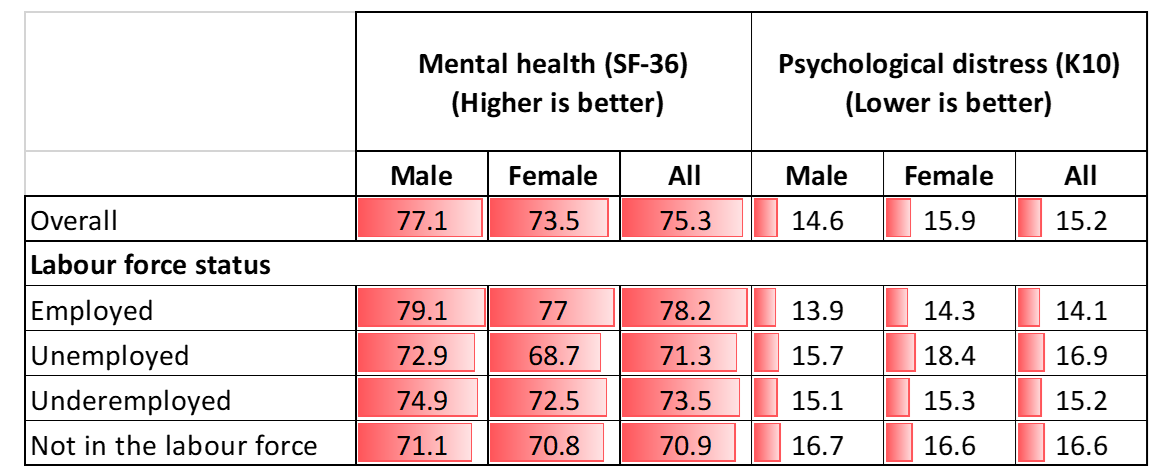

The consequences of such financial stresses on households can be scarring. AHURI research into older homeowners (aged 55 and over) reveals that people still paying off their mortgage score higher on psychological distress scales and lower on mental health wellbeing scores than people who have paid off their home loan. In addition, older female mortgagors generally have lower levels of mental health and higher levels of psychological distress than older male mortgagors. Unemployed women who still have a mortgage have the greatest psychological stress levels and worse mental health, while for and men ‘not being in the labour force’ led to the worst psychological outcomes.

Table 1: Mortgagors aged 55+, 2001–2016

While these findings are for older mortgagors aged 55 and over (who may have anticipated a limited time in the workforce, if they were employed at the time of the psychological distress surveys), they suggest the levels of emotional stress that younger homebuyers may suffer as a result of losing income due to the pandemic and its associated economic downturn.

Homeowners going back to renting

The current 480,000 households who have asked their bank to allow them to defer their mortgage repayments shows the vulnerability so many households feel about their ability to maintain home ownership. In reality, of course, this is not a new phenomenon, it’s simply made the situation more visible. Previous AHURI research found that between 2001 and 2010, Australian households sold their home 1.9 million times and then moved into rental housing (some households then rebought a home, and some even sold that second home during the decade). This was more common for households aged under 50: ‘in fact, 23 per cent of home ownership spells in Australia among the under 50s ended, compared with 16 per cent among those 50 and over’. While 61 per cent of households who sold their home were able to buy another house at some point during the decade, nearly four in ten remained in the rental market.

Socio-economic implications of leaving homeownership

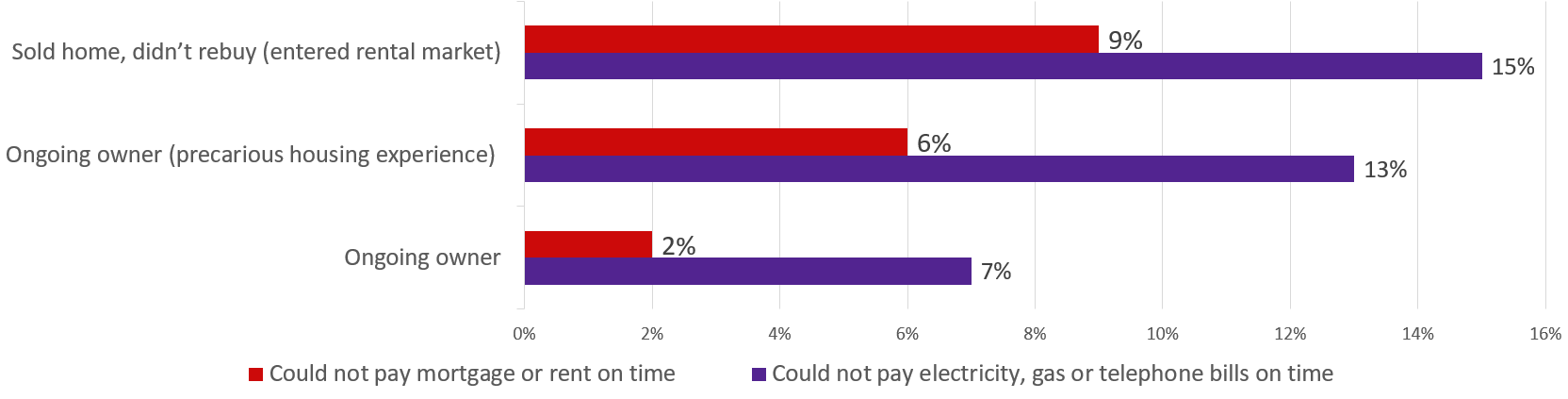

The research also shows that households who left homeownership permanently had worse financial indicators during the time they owned a house when compared to households that either didn’t sell up or who sold and then bought another home. For example, the occurrence of not being able to pay housing costs on time fell over time for most households, but rose for those households that eventually sold and didn’t re-buy housing.

Table 2: Occurrences of material deprivation, by home owner group, 2001–10

If such findings from 2001–2010 hold true for the present economic situation it is likely that a significant number of the households currently wanting to defer mortgage repayments will sell their home and move into rental housing either for a long period or permanently. The research also shows that even after households sell and no longer carry a mortgage debt, their mental wellbeing still drops from 67.8 points to 64.6 points on the SF36 scale (0 = least healthy to 100 = most healthy) after they sell. In comparison, householders who remained homeowners recorded a mental wellbeing score of 73.5 points.