Whether there will be a significant impact on house prices as a result of the economic crisis stemming from COVID-19 is a topic of significant discussion in both Australia and internationally.

The impact on house prices in the wake of the Global Financial Crisis (GFC) (2007–09) provides the most recent comparable example to the current economic downturn and it is worth considering how house prices, and rates if home-ownership changed following the GFC.

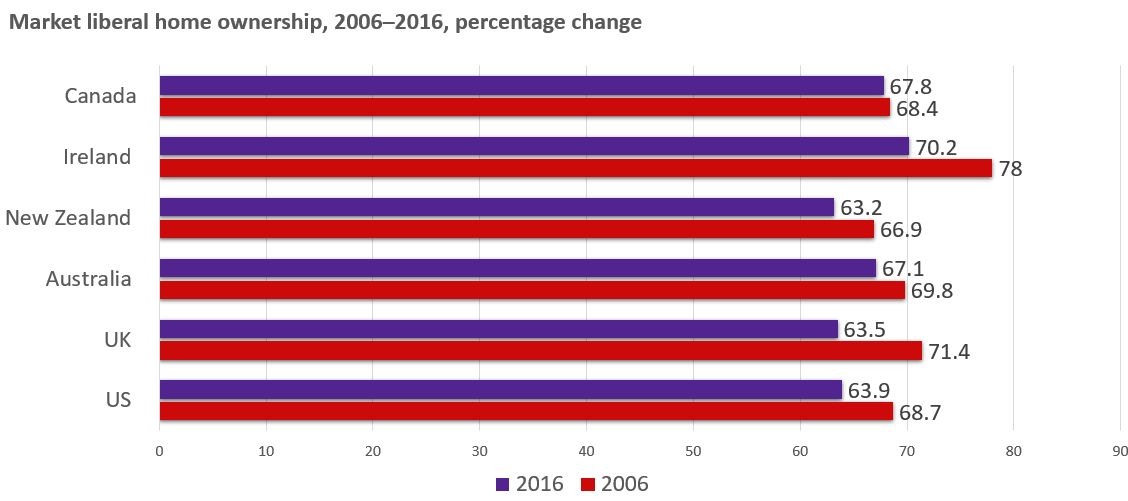

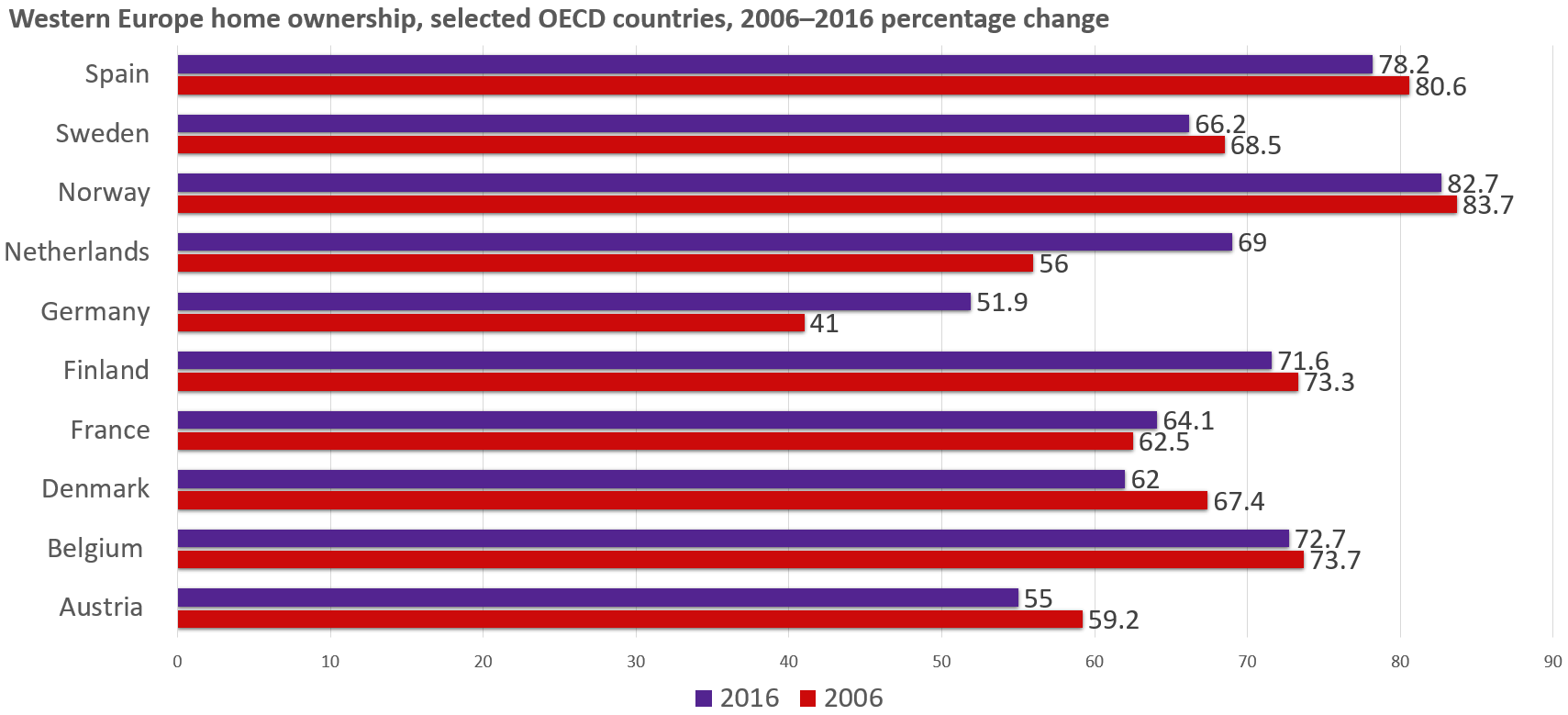

Market liberal vs Western Europe home ownership

Recent AHURI research covering 18 countries reveals that while home ownership fell in most developed countries in the years 2006 to 2016, the biggest falls during the GFC period were in ‘market liberal’ countries. Market liberal countries are those with governments that embrace free markets, private ownership, small government and light financial and policy regulation and include Australia, Canada, Ireland, New Zealand, the US and UK. The research shows that market liberal countries were affected by the excesses of financial deregulation and the associated financialisation of residential property (i.e. that housing prices are underpinned by loans from relatively deregulated financial entities and a growing sense that housing is a form of financial investment).

Only three of the Western European countries—France, the Netherlands and Germany—showed growth in home ownership in the decade to 2016, and these countries came from low base ownership rates. Indeed, the growth in Germany has taken home ownership to just over 50 per cent, equivalent to Australian ownership in the early 1950s. In addition, much of the growth of ownership in the Netherlands came because the financial attractiveness of social housing weakened as housing welfare subsidies were reduced.

Why didn’t falling prices increase home buying?

Particularly in the US, UK and Ireland, which were all badly affected by the GFC and had many households losing their homes, the substantial falls in prices did not bring new home buyers into the market for reasons including:

- loss of confidence in the ownership market—people won’t buy a home if they see a real chance that it will be worth less in the future than what they paid for it

- the tightening of mortgage lending (fewer mortgages and need for higher deposits) as troubled finance institutions attempted to get themselves in order

- the greater attractiveness for finance institutions of other mortgagees, such as rental property investors.

There was also a fall in ownership due to households being forced to sell their homes due to loss of employment income as a result of the GFC, while unemployed people or people on insecure incomes were not able to get a loan to buy a home.

While Canada and Australia had only minor falls by comparison to other countries, the report also attributes a drop in home ownership rates for lower income households to the financialisation of property interacting with historically low interest rates (with the RBA cash rate falling from 7.25% in March 2008 to 3% in April 2009 during the GFC) leading to increases in dwelling prices. (The RBA cash rate in June 2020 is a very low 0.25%.)

Will the current financial crisis have a similar impact?

With the potential for severely reduced employment income for Australian households combined with reduced migration levels due to COVID-19 it is very possible Australia will also experience the anomalous situation that occurred during the GFC of both reduced house prices and reduced home ownership rates, particularly for lower income households.